Before any of us had ever heard of COVID-19, there had been an ongoing uptick, year after year, in customers deciding to do their shopping online, from electronics to books to medicines to groceries, et al. Back in April of 2019, CNBC noted that “The total market share of “non-store” or online U.S. retail sales was higher than general merchandise sales for the first time in history, according to a report from the Commerce Department.”

A recent survey from Statista showed a before-and-after COVID-19 online shopping graph regarding a number of categories. The “after” shows expected growth:

Groceries – 24% before COVID; 38% after (+14)

OTC Medicine – 25% before COVID; 36% after (+11)

Household Supplies – 27% before COVID; 39% after (+12)

Food takeout and delivery – 40% before COVID; 52% after (+12)

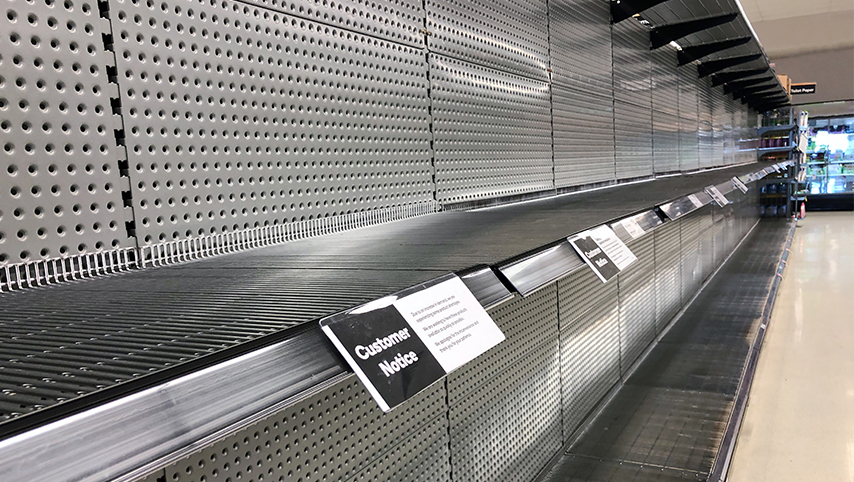

It is clear that the pandemic is accelerating usage of online and many businesses believe that many of these new shoppers may decide to continue ordering this way at least part of the time. This has resulted in a new trend for retailers according to a new article in Fast Company on the rise in “dark stores.” These are online-only stores that have become micro-fulfillment centers. Although some companies, like Whole Foods and Walmart are building stores specifically for this model; however, for others these stores were normal brick and mortar retail locations that have been converted from their normal usage of in-store shopping into online-only stores. Bed, Bath & Beyond, which has been struggling that have led to store closings have plans how to convert one-quarter of their locations into regional fulfillment centers.

Many companies, seeing the change in buying habits over the last decade and more had already developed initiatives to move a portion of their business from in-store to “dark store.” The pandemic merely accelerated that move. Some small businesses and major chains integrated “pick-up” capabilities into the stores, where customers would order online and then pick up their orders. One of the categories most affected have been grocery stores. Forbes found that “Even before the pandemic, the number of U.S. adults who had tried and liked grocery delivery was t 12%, a 50% jump from 2019. Most retailers had been planning for 30% annual growth for e-grocery which accounts for 6% of total U.S. sales, but the pandemic quickly changed those expectations.”

Getting product to where it needs to be

As the move to e-commerce has increased, organizations and shippers have had to reassess how goods are transported. They have had to plan for a JIT (just in time) delivery strategy and delivery routes that are more limited in scope. Many of these dark stores are or will likely be in more densely populated areas, closer to their customer base. That may translate to a need for smaller commercial vehicles and shorter distances traveled, resulting in lower transport costs and shorter delivery time. Logistics and analytics may end up playing a much larger role in this trend enabling fleet operators to know, ahead of time, which vehicles will perform the delivery most efficiently, both in cost and time.

It is important to remember that consumers, now becoming accustomed to quick turnaround time may be willing to wait a bit longer during the pandemic, but once the crisis ends, they will go back to expecting quick turnaround service and retailers who aren’t able to satisfy these expectations will find themselves falling behind their competitors.